Virtual Meeting of the INTOSAI Working Group on Financial Modernization and Regulatory Reform

On March 31, 2022, an online-meeting of the INTOSAI Working Group on Modernization and Legal Reform of the Financial System (WGFMRR) was held. The event was co-hosted by the U.S. Government Accountability Office (US GAO) and Corte dei Conti (SAI of Italy). The meeting was also attended by representatives of the World Bank and the European Central Bank.

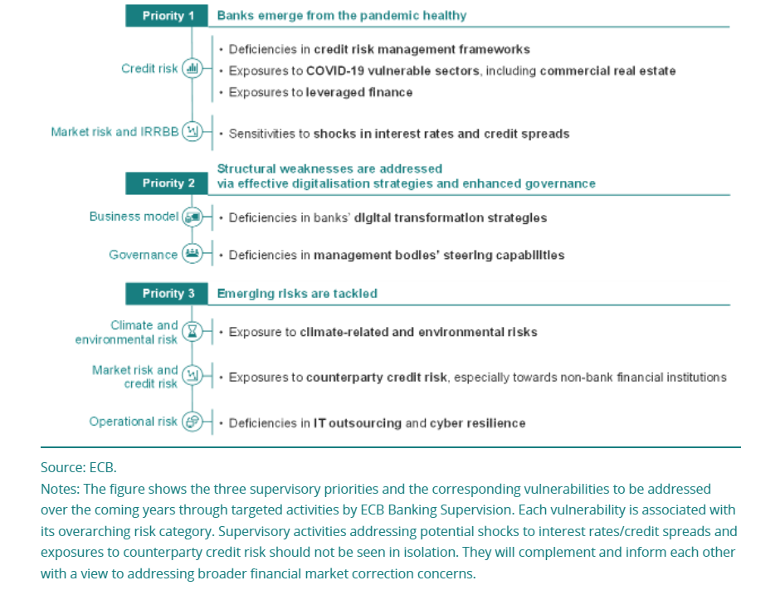

The reports of the World Bank and the European Central Bank touched upon the following issues:

- Most pressing challenges and risks to the banking stability

- Risk assessment methods and asset quality revision in the banking sector

- Сommon approach to the regulatory acts in the banking sector

- Supervisory priorities for 2022-2024 addressing identified vulnerabilities in banks.

The report of SAI Italy “Rebooting economy with parachutes – the recovery plan and the role of SAIs” was focused on the key features of the National Recovery and Resilience Plan and the role of SAI Italy in its implementation.

The report by the US GAO “Macroprudential framework: a new evaluation tool. Macroprudential oversight: principles for evaluating policies to assess and mitigate risks to financial system stability” depicted a framework for evaluating macroprudential policy presenting six general components of macroprudential policy and 18 principles, as well as related standards, for establishing the foundation of such policy and putting it into operation (Tab. 1).

GAO’s Framework for Evaluating Macroprudential Policy. Source: GAO US

- Have a clear mandate

- Have a scope of responsibilities that extends across the financial system

- Establish measurable and specific intermediate objectives reflecting the full scope of its responsibilities

Key underlying concepts in the report were:

- Macroprudential policy: Policy that aims to maintain financial stability through mechanisms — including, but not limited to, laws and regulations – to assess and mitigate potential systemic risks

- Macroprudential entity: All government actors with macroprudential policy responsibilities (e.g., federal agencies, interagency councils, central bank) and a collective obligation to create and carry out macroprudential policy.

The report of SAI China “Financial audit in the context of the COVID-19 pandemic” examined the features of performance and compliance audits on the issuance of relending, fiscal subsidies and the use of funds. The experts highlighted the audit recommendations regarding the resumption of production of micro and small enterprises, manufacturing and transportation industries, evaluation of the bank credit assets quality.

Representatives of SAI China also shared their vision of the main objectives of audits of financial systems under the scenario where the pandemic situation remains uncertain:

- balance between the strictness and flexibility of supervision

- improve the effectiveness of supporting policies

- stabilize market expectation and promote economic recovery.